High commodity prices have increased exposures to energy insurers says the broker

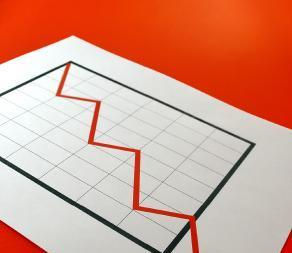

Sharp increases in the price of oil, steel, building materials and contractor day rates have resulted in significantly increased exposures to energy insurers, said Willis.

Despite loss levels in the energy insurance sector remaining low for a second successive year, there is now apprehension in the market as rating levels continue to soften significantly, said a report by the broker.

The Willis Energy Market Review revealed that the “superheated” commodity prices have resulted in increased replacement cost valuations and have provided extra scope for longer and costlier delays in the event of an accident.

The potential for more severe losses in the energy industry has therefore been enhanced, at a time when many asset values remain unrevised for insurance purposes, according to Willis.

Phillip Ellis, chairman of Willis Energy, commented: “While some companies are operating their assets in ways that are far superior to the past, for others the run of good luck is just that. It is very hard for us to accept that this run of low loss activity will continue indefinitely. Ultimately, something will break.”