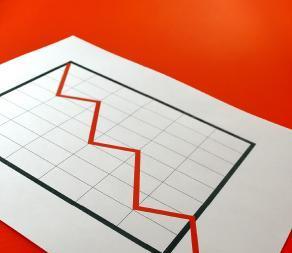

45% increase in payment defaults over the first four months of 2008, notes credit insurer

Coface, a French credit insurer, has noted a net deterioration in the payment behaviour of companies: company payment defaults increased by 45% over the first four months of 2008 compared to the same period in 2007. This is a clear sign of the beginning of a credit crisis, even if this indicator, based on statements of Coface insured clients in the 65 countries where it is present, traditionally over reacts at the start of a crisis. This is why Coface believes the crisis is less significant overall than the crisis of 2001-2002, which was marked by a 30% increase in payment incidents.

Coface said: ‘The financial crisis has rippled through to the actual economy via two channels: the first one by reducing US demand, which mainly affects North America and US-oriented countries and sectors, and the second one by an increased difficulty in accessing bank credit. Added to these factors are increased prices for raw materials and energy, the appreciation of currencies outside the dollar zone, and very stiff competition. For the moment, France and Germany are only slightly affected.’

Coface lowers the rating of seven sectors

Ratings of electronic components, the paper industry, mass distribution, automobile, public works, air transport, and textiles are being lowered, on the worldwide level for some and only in the US and/or Western Europe areas for others.

“Our risk monitoring has been reinforced to allow us to continue supporting our customers in their operations while limiting the impact of the crisis on our results.

Coface CEO Jerome Cazes

Confronted with various forces, these seven industry sectors appear to be weakening at varying degrees:

Overall, few sectors are escaping the crisis, but some like metals, chemicals, engineering, pharmaceuticals, information technology, and communications are managing to reduce the impact of these shocks thanks to the good position of their market and strong internationalisation, particularly in emerging countries where economic conditions are resilient, said Coface.

‘The 5th credit crisis since the first oil crisis, has now begun, and the payment behaviour of companies has clearly deteriorated since the beginning of 2008, even if it has gone largely unnoticed in France, which has nevertheless been slightly effected’, said Coface CEO Jérôme Cazes. ‘Our risk monitoring has been reinforced to allow us to continue supporting our customers in their operations while limiting the impact of the crisis on our results.’

Xavier Denecker, managing director of Coface in the UK and Ireland, added: ‘At present, the UK economy seems surprisingly resilient to the financial crisis, and so far we have only seen a slight deterioration in payment behaviour – in Ireland it is more pronounced. However, it is clear that the cost of protecting against payment default will rise in the coming months having recently reached an historic low. One of credit insurance’s main benefits would then come into play - that of stopping the ‘domino effect’ of business failures. A focus on risk monitoring now will put us in a good position to help our clients in the event that conditions deteriorate.’

No comments yet