As power grids seek to adapt to the transition to renewable power generation, energy storage solutions, including battery storage, gas peaking plants and hydroelectricity, are touted as one solution to grid volatility

As nations make the transition from coal-based power economies to renewable power economies there is anticipated to be a massive impact on power grids. In the UK, for instance, the government has committed to a programme that will phase coal out of all electricity generation by 2025.

Future energy needs will be met by renewables, nuclear power and power sharing via interconnectors with neighbouring countries (more on this in our feature on interconnectors). “Coal and gas-fired power stations have been the absolute main baseline capacity drivers of the UK’s grid for decades and decades, says Duncan Gordon, renewable energy broker at Alesco. “Now that’s changing, and the grid has needed to adapt”

“In terms of the overall contribution to the grid it’s definitely wind that’s been the major success,” he continues.”2017 was a headline year, with wind providing 15% of the UK’s annual electricity supply and the grid has come to rely on it. Combined cycle gas turbines and nuclear provide the baseload capacity requirements but the increasing contribution of solar and wind to the grid has raised the volatility profile and increased the need for new capacity to run and be available intermittently.”

2017 was a headline year, with wind providing 15% of the UK’s annual electricity supply and the grid has come to rely on it

Unlike traditional coal power, electricity production by weather-dependent renewables such as wind and solar can vary quite considerably depending on the time of day, time of year and whether or not the wind is blowing. This causes peaks and troughs in supply that older grids were not designed to cope with, leaving grids more susceptible to sudden variations in power generation or consumption.

Any shortfalls are most likely to be experienced during the November to January winter period when the days are shorter and colder. On top of this, there are variations in energy demand. Take the World Cup for instance. National grid operators know there will be a surge in demand at half time when England is playing and when up to 20 million viewers switch on their kettles at the same time.

As power grids seek to adapt to the transition to renewable power generation, energy storage solutions - including battery storage - are touted as one solution to grid volatility. “Whilst grid stability has largely been supported by interconnectors, demand-side response, gas plant upgrades and gas peaking plants the National Grid’s storage contracts have also provided entry for battery asset systems to be installed” says Gordon.

“Initially the utilities installed large battery systems, but in time private developments have completed with project finance taking advantage of short-response contracts, two to four years, followed by longer term capacity contracts.”

To maintain a continuous service, generators are called upon by the grid to make constant readjustments to supply in response to demand. Whether supplied by pumped hydro-electric resources, battery storage or gas peaking power, these generators need to be able to respond quickly to level the demand curve on the grid.

There are various risks and opportunities presented by energy storage, including the degradation of battery performance over time. As Gordon explains: “Due to the warranties provided for components like inverters and battery units, you can wrap the performance output with an insurer and cover the availability of the system as a whole. This allows EPC contracts to offer an attractive contractual position to the asset owner. Operationally, there is healthy insurer appetite to offer ‘all risks’ material damage cover including mechanical and electrical breakdown and natural perils.”

Insurance can also be used to cover machinery breakdown and fire damage, in addition to non-physical damage business interruption, such as where a generator misses out on national grid payments due to an incident outside of its control. “In this sector particular consideration must be taken with business interruption policy language to ensure full indemnity is provided for an asset’s forecasted revenues, and the contractual mechanisms of those,” says Gordon/

Bloomberg New Energy Finance anticipates the energy storage market will double six times by 2030. While battery storage parks are still a relatively expensive technology, prices are expected to reduce as it becomes an established way of keeping electricity supply and demand balanced.

As the technology becomes more widespread there are other potential applications, including the anticipated growth in electric vehicles. “Electric vehicle increase and targets to stop production of fossil fuel vehicles is a large accompaniment to storage solutions long term,” says Gordon. “This will see a long term increase in demand for electricity supplied affordably, at all hours.”

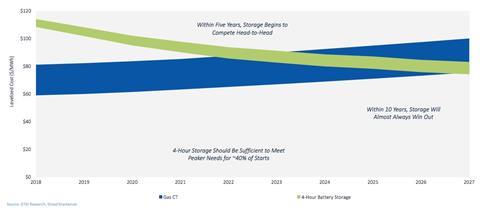

Peaking gas combustion turbine versus four-hour lithium-Ion battery storage ($/MWh)

Source: GTM Research, Wood Mackenzie

No comments yet