AXA Corporate Solutions’ CEO expects insurers to pass higher costs onto their clients not their shareholders

Risk managers will be faced with higher prices from their insurers as a result of the Solvency II regime, according to Jean-Paul Rignault, chief executive officer of AXA Corporate Solutions.

In a press conference at the Ferma Forum in Prague Rignault told journalists that Solvency II will increase the amount of capital that insurers have to retain and rather than passing the associated costs onto their shareholders insurers will be forced to pass them onto clients.

Under the Solvency II risk based capital regime, due for implementation in 2012, insurers will be more focused on ‘properly remunerating their shareholders’, indicated Rignault, and that could translate into premium hikes ‘wherever it is appropriate’.

‘We will need more capital to conduct the same business under Solvency II,’ he said.

Certain parts of the insurers businesses will be put under more pressure than others as a result of the new regime.

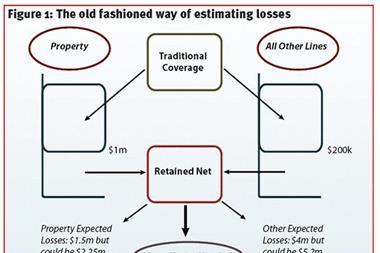

Capital, which is in scarce supply, will be invested where the return is highest, said Rignault, adding that highly volatile lines of business, such as large corporate risk, particularly property, will not be the most attractive place to invest. There could be some affordability and availability issues for certain lines of large corporate risk, he said.

But he indicated some insurers will be able to weather the storm better than others. ‘If you can demonstrate that your activity is highly diversified then it will reduce the need for capital,’ commented Rignault. ‘Any insurance company involved in mono-line activity will have a higher step to climb due to the lack of diversification.’

The new regime could also bring some benefits to risk managers. Rignault said the system is a good thing because it will force insurers to assess their risk appetite and the appropriate capital base that they need to conduct their business. He also said it would provide a better way for policyholders to compare the solvency margins of different insurers based on the same European wide criteria.