Companies must become shock absorbent to avoid the next big crisis, says Dr Axel Sitt, head of risk and resilience services at Eraneos.

We’re living in the “never normal,” said Dr Axel Sitt, head of risk and resilience services at Eraneos.

He told the audience at the Risk-!n conference in Zurich that the pace of change, unpredictability, degree of uncertainty and the connectedness of events have transformed the world we live and work in.

The Covid-19 pandemic was a worldwide crisis. Now many organisations believe they have survived and are resilient. We have a totally new normal, and things like working from home are here to stay despite being inconceivable in the pre-pandemic world.

However, Sitt cautions that businesses must not become complacent. He said: “We’re more digital, and we’re better than before, but that doesn’t mean everything is alright. It’s a jungle out there. There’s a lot more looming in the dark which is coming up.”

He points to four key contributory factors that will make the next crisis even more dynamic:

- Hyperconnectivity. Something happens and it has an impact in corners of the world that we couldn’t have expected.

- Ultra speed. Everything is fast and we have to keep up with it.

- Non-linear. We can’t predict from the past what will work in the future.

- Superfluidity. Companies moving into new industries and markets,.

“[This creates] a greenhouse for more crises, so you better get prepared because the next shock is on the horizon,” Sitt warned the audience of risk managers.

He added that the next big crisis is likely to come from one of four areas: technological, biological, geopolitical or ecological.

To manage this crisis, risk managers must avoid several key traps, such as an overreliance on probability.

Sitt explained: “We love to use probability in risk management and it’s so stupid. We don’t take account of low probability events because we think they won’t happen. That approach needs a stable environment, data, and a distribution function, which we don’t have.”

Other common pitfalls include internal biases, focusing on offence and neglecting defence, overreliance on “quick and dirty” solutions without addressing the root causes of risk, and underestimating the dynamics of disruption and how fast you need to act.

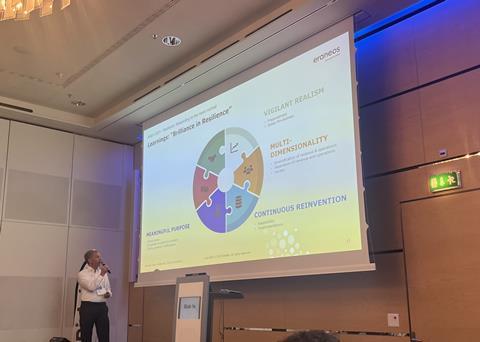

To overcome these traps, Sitt said there were six key areas that risk managers must focus on.

- Vigilant realism – through preparedness and sober-mindedness

- Multidimensionality – through diversification and separation of revenue and operations.

- Continuous reinvention – through adaptability and experimentation

- Strategic Foresight – through scenario planning and crisis simulation

- Entrepreneurial leadership – through culture, inventiveness and leadership

- Meaningful purpose – through strong values, compassion and supportive systems and finding meaning in difficulties.

Sitt concluded: “A single spark may trigger a number of scenarios and it could be much quicker than you expected. We have to look at shocks and scenarios and find out which of those could hit us in the future.

“What you need to become is a shock-absorbing organisation. You’ve got to change certain things, and that includes changing the mindset from failsafe to safe to fail. You will have hits, you may lose money in the process, but f you want to become resilient, you may have to lose parts of your organisation rather than losing the whole. If you don’t do it, your competitors will.”

No comments yet