Asia-Pacific’s renewable energy sector is poised for growth, placing greater pressure on finding the best risk management solutions to prevent and mitigate the risks

The coastal waters of South East Asia are ripe for wind power generation. China is investing $100 billion in wind power expansion plans as part of the country’s ambition to install 5 gigawatts of offshore wind capacity by 2020. Meanwhile, Taiwan has given the all-clear for eleven offshore wind projects by seven developers that are due to come online between 2020 and 2025.

However, as the sector takes off, with wind power growing in double digits across Asia in 2017, largely driven by new Chinese installation, developers and operators are turning their attention to the region’s catastrophe exposures. Most of the sites for new projects are at risk of typhoons and earthquakes, risks that will need to be managed carefully as the industry takes off.

A number of storms have caused damage to offshore wind turbines. This includes Super Typhoon Soudelor, which damaged several in a wind farm in Taiwan in 2015, as well as Super Typhoon Usagi, which damaged turbines on the coast in China’s Guangdong Province. As these examples demonstrate, wind turbines are vulnerable to very high wind speeds. However, the full impact is still not fully understood, according to Guido Benz, head of engineering and construction, at Swiss Re Corporate Solutions.

“You can simulate the exposures to a certain extent but it’s not until you have an event - a tropical cyclone running through an offshore wind project - that you’re really able to see how well the equipment can withstand the force of the wind.”

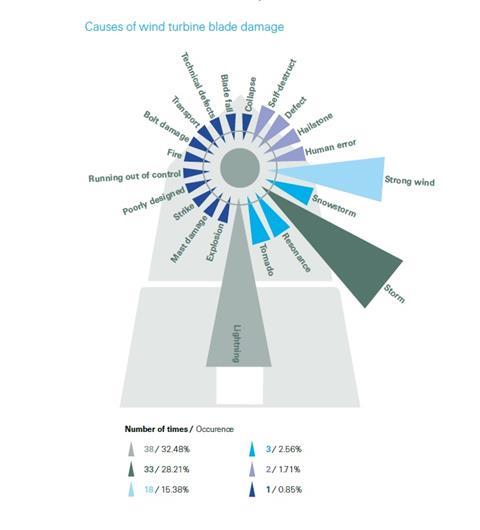

Source: Swiss Re, offshore wind power in stormy seas

Earthquake is another concern, particularly near the coast of highly-seismic regions such as Taiwan and Japan. Cables and foundations are particularly vulnerable with damage to four submarine telecommunications following landslides created by a M6.4 earthquake in 2010, illustrating the potential exposures.

One possible solution could be floating wind farms, with Hywind Scotland - a pilot 30 MW project comprising five turbines initially - pointing the way. Coastal Japan, the South China Sea and deeper oceans, such as those off the West Coast of the US and Hawaii, are expected to be a big beneficiary of the technology.

Instead of fixed turbines, where water depths of 20-50 metres are optimal, floating turbines are fixed to the sea bed using chains and can be installed at any depth. Following the initial pilot, the cost of the technology will become more competitive, according to Norway-based renewable developer Equinor [previously named Statoil]. It predicts floating turbines will give wind the potential to produce more than 100 GW globally by 2030.

The business interruption and consequential financial loss tends to be the big ticket item

Beyond the direct damage caused to installations, project operators also need to consider the damage that natural catastrophes can cause to the wider grid and look to mitigate or transfer the risk via insurance solutions. “The business interruption and consequential financial loss tends to be the big ticket item,” says Benz. “During the construction phase for offshore wind farm you have delay-in-start-up cover, which can be triggered if anything relating to the connection into the grid - either from onshore substations or export cable - is damaged.”

However, for projects operating in these high natural catastrophe exposed areas, affordable insurance capacity may become harder to find as the sector develops. Re/insurers practising aggregate management can only write a certain amount of catastrophe business in any one area, explains Benz.

“It becomes an accumulation issue,” he says. “And if you look at the speed at which the offshore wind sector is growing in Taiwan, China and Japan, then there’s a question mark around that and whether the conventional insurance products that we have today will be sufficient to deal with those exposures.”

“When we look at the example of Taiwan, for instance, by 2025 we expected something like $20 billion invested into offshore wind, which is roughly 5-plus GW of installed capacity,” he continues. “So if that was fully exposed to nat cat perils like tropical cyclone and earthquake then it is unlikely there would be enough traditional insurance capacity to take that on.”

“At Swiss Re, we’ve been actively engaged in providing insurance to offshore wind farm projects in Taiwan, China and the wider region, because it’s a growth area,” he adds. “The question is, how long can we be as active as we are today? Will we arrive at a point where we say we’ve maximised our net capacity that we are willing to deploy?”

There is the potential for parametric and other alternative risk transfer solutions to come in at that point and plug the gaps, thinks Benz. This could include products such as weather hedging derivatives and insurance-linked securities (ILS).

No comments yet