While Germany is set to maintain its growth in 2018, the spectre of a hard Brexit, rising protectionism and US tariffs could dampen the economy’s potential

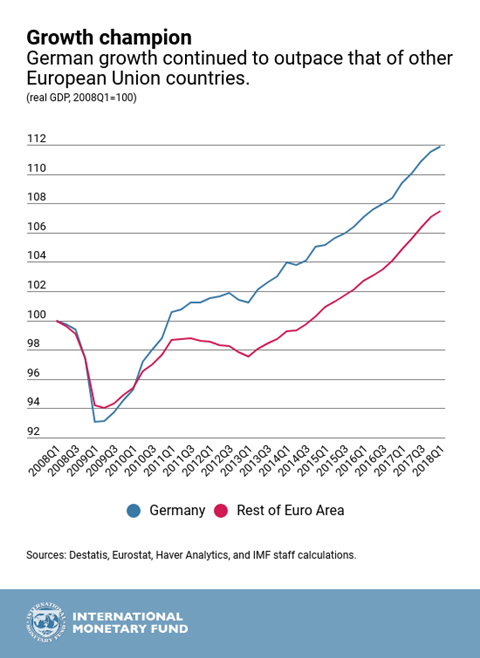

The outlook for Germany’s economy is bullish, with the International Monetary Fund anticipating a “golden opportunity” to address medium-term challenges and shape a brighter future. It anticipates economic momentum will be maintained in 2018, citing dynamic business investment, job creation and rising wages amongst the factors boosting performance.

However “rising protectionism and the threat of a hard Brexit” are somewhat dampening the outlook, with the IMF cutting its growth forecast for 2018 to 2.2% in early July. This compares to GDP growth of 2.5% in 2017.

Among the future challenges likely to be faced by the German economy is the country’s unfavourable demographics, with an aging population impacting the workforce. Solutions to this include pension and labour market reforms. IMF directors stressed that the positive near-term economic outlook for the country provided an opportunity for Germany to address its changing demographics and other longer-term challenges.

The IMF cites Germany as an “innovation leader” but says it needs to encourage venture capital funding to help start-ups at the growth stage. Tax incentives for SMEs and reduced administrative burdens are seen as further incentives to fostering entrepreneurship.

The risk that US President Donald Trump will impose tariffs on a wide range of US imports could also impact Germany’s near-term prospects. While Trump and European Commission president Jean-Claude Juncker announced a truce over the imposition of tariffs, concern remains that the tariff threats could impact business confidence.

Exports to the US exceeded imports by €24.4 billion in the first half of 2018, barely unchanged from its surplus of €24.5 billion in the same period of 2017. However, a fall in manufacturing output in June has fuelled concern over an export-led slowdown. New orders placed with German manufacturers were down by four percent during the month, according to official figures published in August.

In a letter to US Commerce Secretary Wilbur Ross, BMW of North America warned that US tariffs could result in retaliatory measures by China, Japan and South Korea, “potentially leading to strongly reduced export volumes and negative effects on investment and employment in the US”.

It is currently too early to tell whether the threat of import tariffs and fears of a resulting trade war will spill over to the real economy. Early composite purchasing manager’s index (PMI) figures from IHS Markit suggest manufacturing output will rebound in the third quarter, but analysts have warned that companies could yet reconsider their investment plans in anticipation of a global trade dispute.

“The divergence between an improving current assessment and weakening expectations suggests that at least up to now, trade fears are only fears and not a drag on growth (yet),” said ING Germany chief economist Carsten Brzeski in a statement.

“In an export-oriented economy - in which the US is still the largest export destination - the prospects of more complicated trade are raising concern,” he added. “For now, the German economy clearly shows sign of fear but does not feel it.”

No comments yet